how we can work together

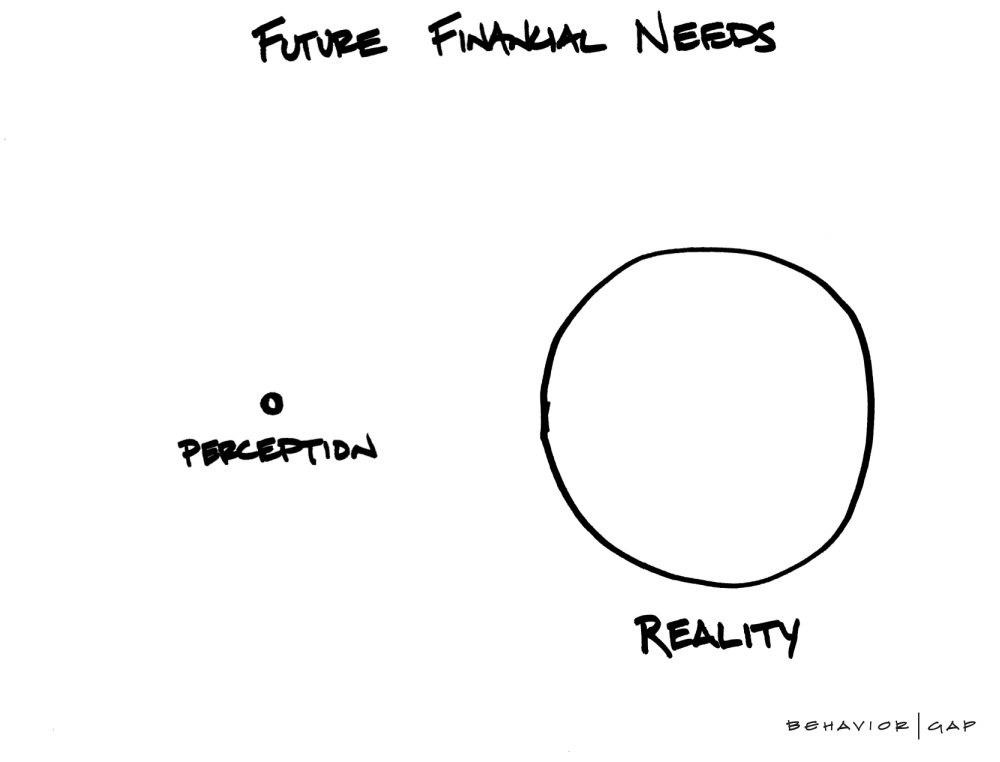

RETIREMENT PLANNING

We will create a retirement plan designed for your future. There are so many facets to retirement planning.

- Will you be financially ok in retirement?

- Will you run out of money?

- Will you have to sacrifice your lifestyle in retirement?

- How much money do you need to save each year to make sure you will be ok down the road?

- Will you be able to retire on your terms?

- What about Social Security?

- Can you spend money today, and still know that you are on track for your retirement?

It’s not the end of the world. You just need clarity, a plan, and someone to advise you on what you need to do. Wouldn’t that feel good? Just breathe. 😊

Together, we can build out specific action steps that can help you work towards your retirement goals. You totally got this! We will be with you every step of the way!

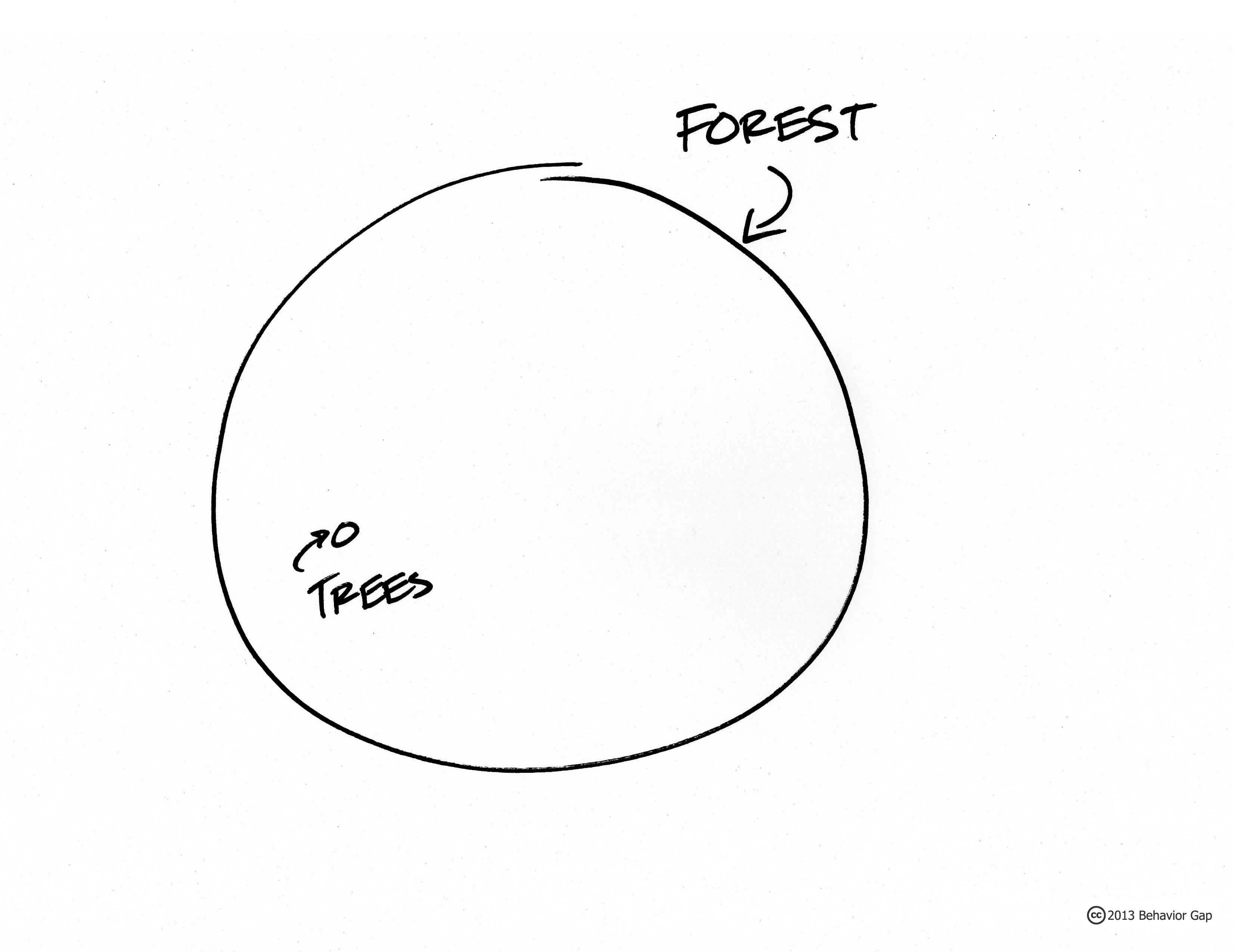

FINANCIAL LIFE PLANNING

It’s not just about return on investment. It’s about Return on Life.

It’s about using your values to identify what’s important to you – and making financial decisions to get more of what you want.

What do you really want for your life? What kind of things and experiences do you want? In 1 week? 5 years? 15 years? 30 years?

Let’s create a financial plan to work towards that.

INVESTMENT MANAGEMENT

Let’s create a customized portfolio for you – from scratch. A portfolio that we will build for you based on your goals, objectives, and risk tolerance.

One of the most important things about investing is the term compounding of interest. It’s when your portfolio grows over time – because your money is working for you.

Can I guarantee this? No. But I can create a system for you – my style of managing money – with the goal of compounding your money over time.

I have used this investment management system for my clients for over 20 years. I love it. It’s simple to understand. It’s the engine with the goal of driving you towards what you want for your financial life.

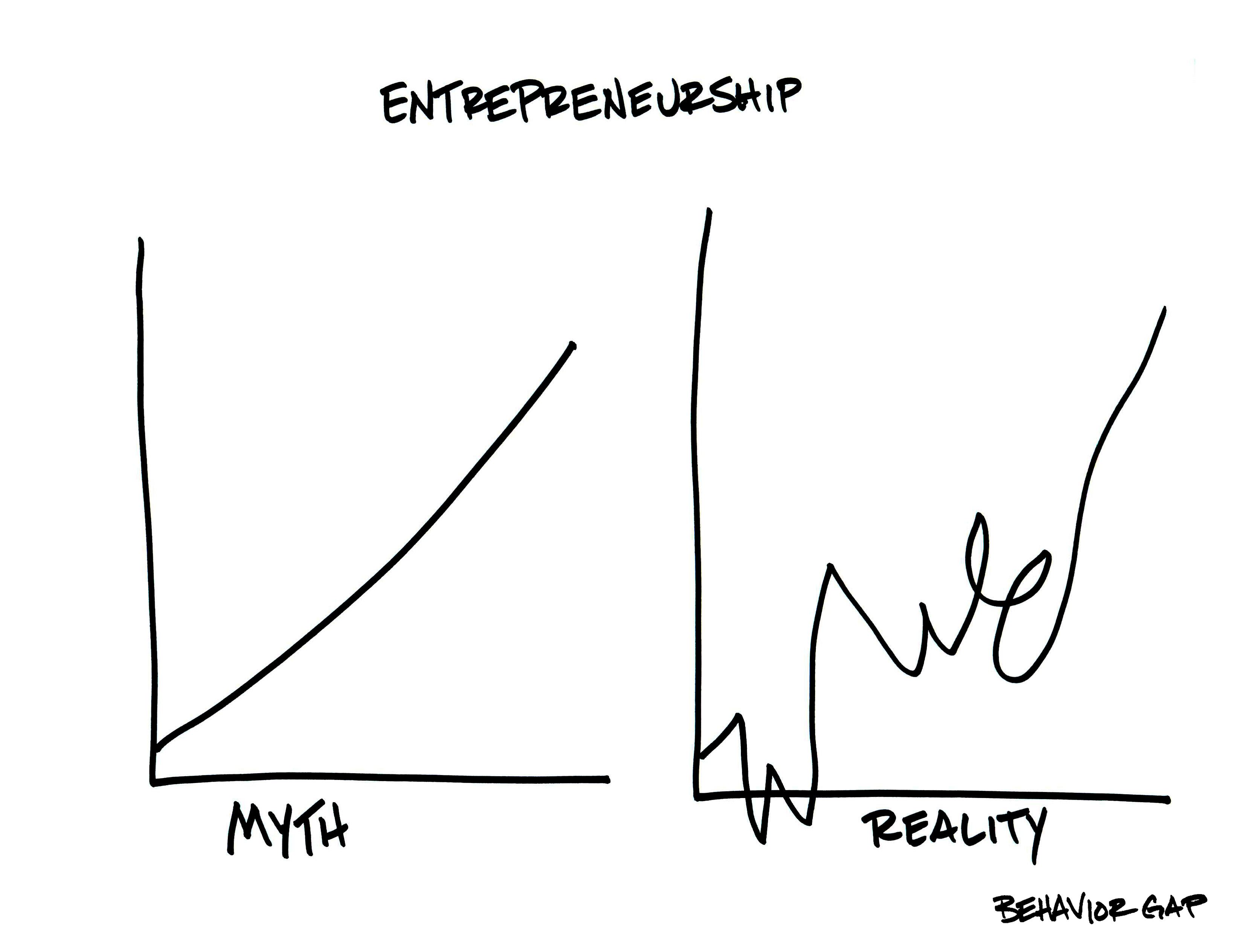

CFO FOR YOUR BUSINESS

Your business money. Sales. Cash flow. Profits. It’s one of the primary drivers of your net worth.

Let’s dig into the numbers. Lets be strategic with your business money.

We will create strategies for :

- Tracking key performance indicators

- How to work with your bookkeeper

- Pricing strategies

- Making smart investments in your business

- Designing a marketing campaign while being mindful of your business money